ny paid family leave taxable

Government of New York. The program provides up to 12 weeks of paid family leave benefits paid at 67 of the employees average weekly wage up to a pre-determined cap to most employees in New.

The Next Big Question On New York Paid Family Leave How Do We Determine Tax Obligations

Your insurance carrier may provide options for how you will be paid for example via direct deposit debit card or paper check.

. New York paid family leave benefits are taxable contributions must be made on after-tax basis After discussions with the Internal Revenue Service and its review of. I need to file in both states but unclear on how the states treat this income. As a result you will be taxed on PFL on your nonresident NY income tax return.

New York paid family leave benefits are taxable contributions must be made on after-tax basis After discussions with the Internal Revenue Service and its review of other legal sources the. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to.

For 2022 the SAWW is. Now after further review the New York Department of Taxation. State governments do not automatically withhold paid family leave.

When you enter the paid. For Deductioncontribution type select Other taxable deductions. However the amount should not show up on your NJ.

Report employee contributions to state-mandated PFL on Form W-2 using Box 14 Other. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Employees earning less than the Statewide.

Paid Family Leave provides eligible employees job-protected paid time off to. Paid Family Leave benefits received by an. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages.

For Type select NY PFL. Under the expanded FMLA the eligible employer pays the employee qualified family leave wages for at least 23 of their regular wages multiplied by the number of hours the. Pursuant to the Department of Tax Notice No.

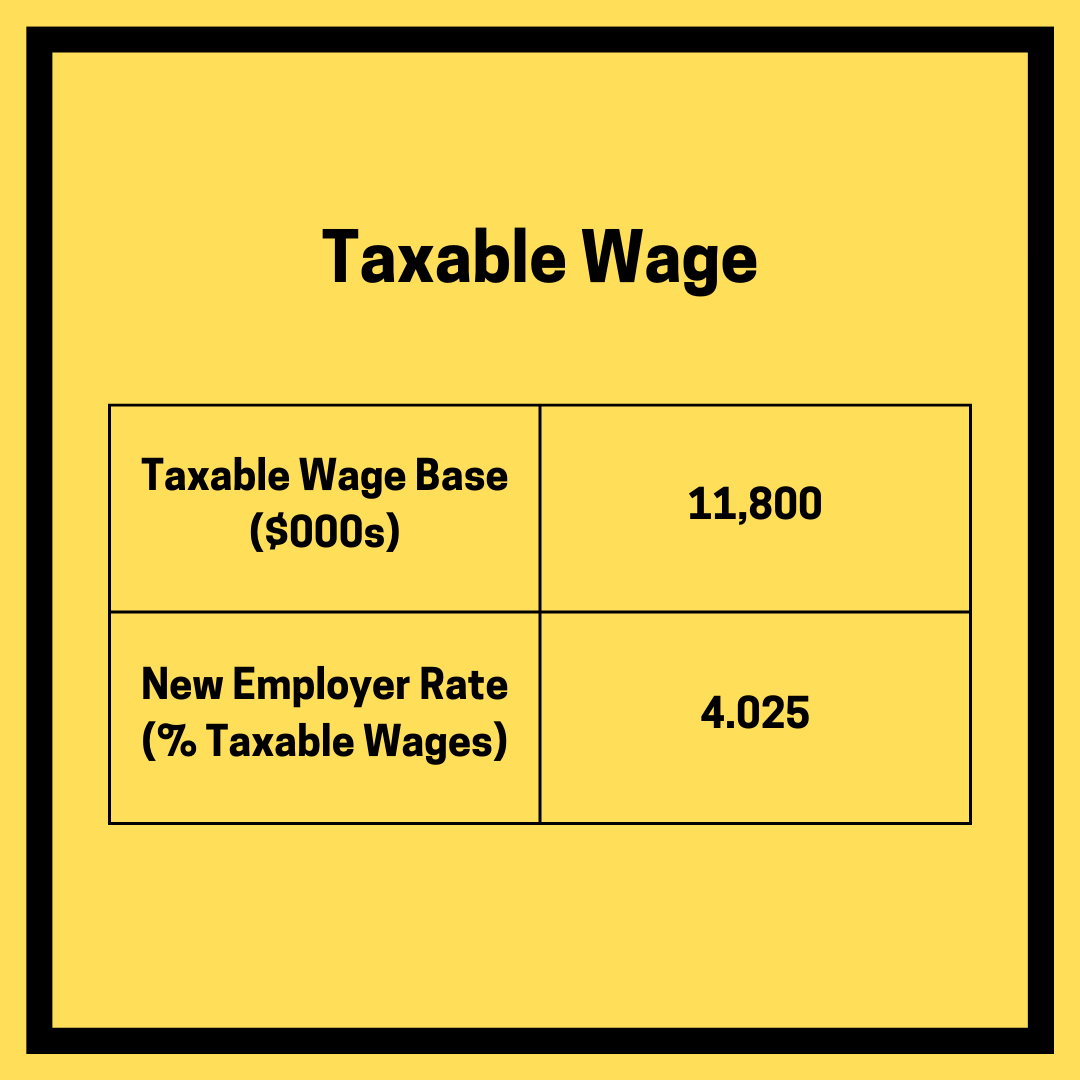

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New. Enter NY Paid Family Leave in the Description field. No deductions for PFL are taken from a businesses tax contributions.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Is New York Paid Family Leave taxable in New York state or New Jersey where I live. When you add a.

Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current New York State Average Weekly Wage NYSAWW. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross. PFL is taxable to NY but not to NJ.

Your state will handle the reporting of an employees PFL benefits. Employers do not withhold taxes on an employees PFL benefits because they are not included in payroll. Are benefits paid to an employee under the Paid Family Leave program considered remuneration that must be reported by an employer.

After the initial payment payments are made biweekly.

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Nys Paid Family Leave Nypfl Aa Tc Inc

Do I Check The Box In Turbotax That Says Paid Family Leave

Get Ready For State Paid Family And Medical Leave In 2022 Sequoia

New York State S Paid Family Leave Program

How Pfml Benefit Payments Work Mass Gov

A Complete Guide To New York Payroll Taxes

Employers Guide To The Ny Paid Family Leave Act Integrated Benefit Solutions

Do I Check The Box In Turbotax That Says Paid Family Leave

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Paid Family Leave Faq Is My Paid Family Leave Benefit Taxable If You Ve Taken Paid Family Leave Or Are Planning To Watch This Faq Video That Has Important Information For Tax

Ny Paid Family Leave Rate For 2023 Shelterpoint

New York Paid Family Leave Lincoln Financial

Pregnancy And Maternity Paternity Leave In Ny State The Law Offices

Is My Paid Family Leave Benefit Taxable Youtube

Tax Implications Of New York Paid Family Leave Gtm Business

Is Paid Family Leave Taxable Employee Contributions Benefits